It is a unique 5 digit number.

Mat su borough taxes.

The parcel id is another method to search myproperty.

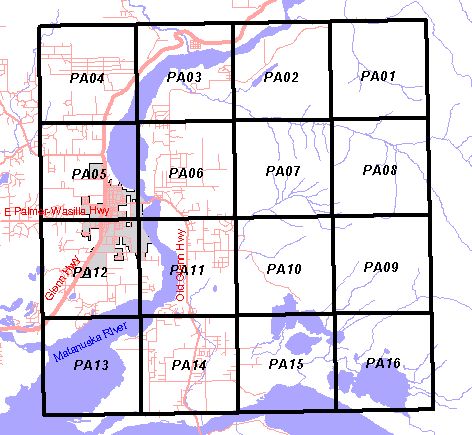

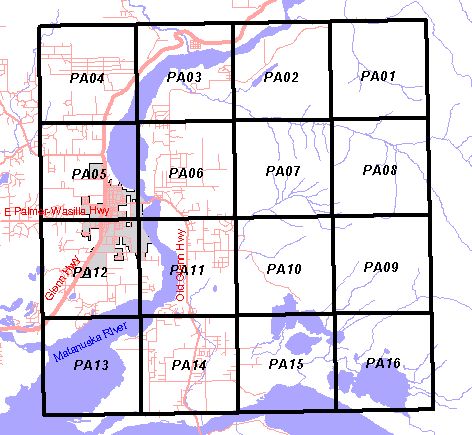

The dxf format is intended for use in mapping programs such as autocad and arcmap.

United way community resource guide.

Until then when paying online with point and pay a convenience fee of 2 95 for taxes and 3 per hundred.

The matanuska susitna borough known as the mat su covers over 25 000 square miles with a diverse collection of communities and is the fastest growing area in alaska.

Mat su convention and visitors bureau.

The borough vehicle registration tax is collected as a part of the standard vehicle registration tax.

Permanent registration the mat su is the first municipality to opt into the state s permanent car and trailer registration program for older vehicles.

Matanuska susitna borough has one of the highest median property taxes in the united states and is ranked 292nd of the 3143 counties in order of median.

The median property tax in matanuska susitna borough alaska is 2 436 per year for a home worth the median value of 212 000.

Tax bills were mailed out by july 1 as required by state law.

These fields will accept all or a part of a tax id or parcel id.

Property value and taxes what do property values have to do with taxes.

The pdf formats can be easily viewed by most users.

This article explains the why and how taxes are assessed for the mat su borough.

The tax id also known as the the account id may be found on your tax bill.

Taxmaps are available in pdf and dxf formats.

Amount in dollars mat anuska su sitna borough.

Please call the main borough number at 907 861 7879 and ask for assessments.

Please pay all other planning department fees by check or money order and mail to matanuska susitna borough 350 e dahlia ave palmer ak 99645.

Tax id parcel id search.

Use the search of tax maps box.

To ensure your payment is credited accordingly include the fee.

Mat su ecommerce online.

The mat su is a great place to raise a family get an education and run a business.

Welcome to the matanuska susitna borough tax map download page.

Assessment staff can answer questions and look up tax information if needed.

Matanuska susitna borough collects on average 1 15 of a property s assessed fair market value as property tax.

Mat su borough school district.

Properties are appraised so that the costs of schools and fire protection and other public benefits are borne in proportion to the amount of money our individual properties are worth.

You can find these maps two different ways.